The Roles of Technology and AI in Global Trade Tensions

As the world moves towards a carbon-neutral economy, China's monopoly of major raw resources amplifies the inelasticity of the supply chain for critical components. This could negatively impact organisations' net promoter scores as they grapple with limited access and influence over suppliers.

China is aiming for growth within EV, battery and energy manufacturing, but this shift could heighten global tensions especially with the US, as Chinese leaders continue to invest in decarbonisation and increase demand for commodities such as copper and lithium.

Mehmet Demirci is the Senior Vice President of global presales solution consulting company e2open, a connected supply chain software platform which helps businesses manufacture their products and provide services in the most efficient way. e2open’s SaaS platform predicts problems and opportunities which allow businesses to reduce waste and perform to the highest level. Naturally, Mehmet is tracking global tensions which could impact the manufacturing sector.

Intensifying global trade tensions and the manufacturing sector

The divisive nature of China's initiatives, which intensify global trade tensions — particularly within the US — have a specific impact on the manufacturing sector.

“The evolution of China's demographics and economic landscape have contributed to a shift in their approach to manufacturing and trade policies,” he says.

Over the past few years, China has experienced substantial demographic changes, with its population assimilating characteristics similar to those of the Western world. This has prompted a need to protect the local economy and intellectual property, leading to the implementation of policies aimed at ensuring economic stability and growth.

“The traditional world factory model that China has operated under for more than 50 years is now approaching its sunset,” Mehmet continues. “The country has been moving away from low-end, labour-intensive manufacturing towards higher-tech, full-spectrum product manufacturing.”

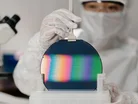

This shift focuses on innovation-led growth and self-sufficiency, especially in industries crucial to national security, such as agriculture and energy, and in high-tech components like semiconductors, where China has historically relied on imports. The complex nature of the global supply chain is further exacerbated by China's initiatives.

“There is increased uncertainty, volatility in raw materials and critical components, supply assurance uncertainties and volume pressures,” he explains. “This complexity has created a more challenging global trade reality for the manufacturing sector.”

In response to this, there is a growing necessity for advanced digital supply chain capabilities that leverage AI and automation. These technologies help manufacturing operations navigate the uncertainties, disruptions and exceptions that have become the norm in the current landscape.

“The end of the supply chain is now characterised by a more demanding customer who expects a wide array of product choices, immediate availability and minimal impact on their daily routine,” Mehmet says. “To put this into perspective, e2open trade experts have gone from making more than 23m to more than 73m changes to their Global Knowledge database in 2023 alone. This datapoint alone should give you an idea of the increase in complexity we are currently immersed in.”

China's strategy contributes to preventing a recession, while simultaneously causing imbalances for specific products within the manufacturing sector and across the supply chain.

“Simultaneously, Chinese banks are shifting from lending to the domestic property sector to funding Beijing's manufacturing sectors, pressuring advanced economies to fulfil demand cost-competitively,” he says.

The trend of nearshoring and friend-shoring could benefit countries like Mexico and Vietnam, altering global manufacturing shares. High-tech organisations such as Intel, HP, Dell and Apple, have been dealing with problems like raw material shortages since their inception, so this transition offers opportunities for companies, originally addressing high-tech industry challenges, to support diverse industries facing similar supply chain issues amid escalating trade wars.

“It emphasises the need for companies to gain control over their multi-enterprise supply chain to adapt their end-to-end value chain considering growth, costs, margins and risks,” Mehmet explains.

Technology and AI can provide manufacturers with the transparency required to navigate potential economic imbalances

In navigating potential economic imbalances, Mehmet argues that technology and AI can play a pivotal role in providing businesses with the transparency needed to address the intricacies of today's dynamic economic landscape.

“One key aspect is leveraging technology to enhance supply chain management. By integrating various parties, data and systems, businesses can move beyond the manual efforts of periodic strategic network redesigns,” he advises. “Instead, real-time visibility and collaboration across the entire supply chain enable proactive issue resolution and strategic decision-making.”

This shift from chasing data to acting on data allows supply chain professionals to focus on value-added tasks that can directly impact the profit and loss of the organisation.

Additionally, the infusion of AI into business processes contributes significantly to addressing economic imbalances. While AI is not a silver bullet, Mehmet stresses that it holds practical and theoretical promise in enhancing forecasting, market predictions, risk detection in the supply network and predictive simulations to rectify imbalances.

“AI-driven automation can optimise impactful actions, aiding in the identification of new supply sources and providing insights into the consequences of human-led decisions,” he says.

However, the importance of human decision-making and collaboration remains paramount. A new integrated operating model is necessary, where AI and technology complement the strategic analysis and collaborative efforts of teams, ensuring faster, more informed decisions based on accurate data and facilitating adaptive responses to economic uncertainties and disruptions. One such disruption no one wants to think about is a conflict between China and Taiwan.

“Taiwan dominates global advanced semiconductor production, contributing around 6%, or US$6trn annually, to sectors worldwide,” he explains.

Taiwan's role in producing advanced semiconductors makes it a linchpin in the global supply chain. The Taiwan Strait is also a vital shipping lane, adding to its significance, which has been highlighted by the Red Sea Conflict.

Yet Taiwan's top trading partners are China and the US, both being powerful economic powers, further emphasising the potential far-reaching consequences of any conflict involving Taiwan.

“Overall, in a wartime scenario, Taiwan's economy would face severe consequences, causing extensive disruptions across manufacturing sectors and leading to prolonged unpredictability and supply chain issues,” Mehmet adds. “This could result in increased costs and prices, triggering market imbalances, economic vulnerabilities and potential recession.”

*******************

Make sure you check out the latest edition of EV Magazine and also sign up to our global conference series - Sustainability LIVE 2024.

*******************

EV is a BizClik brand.